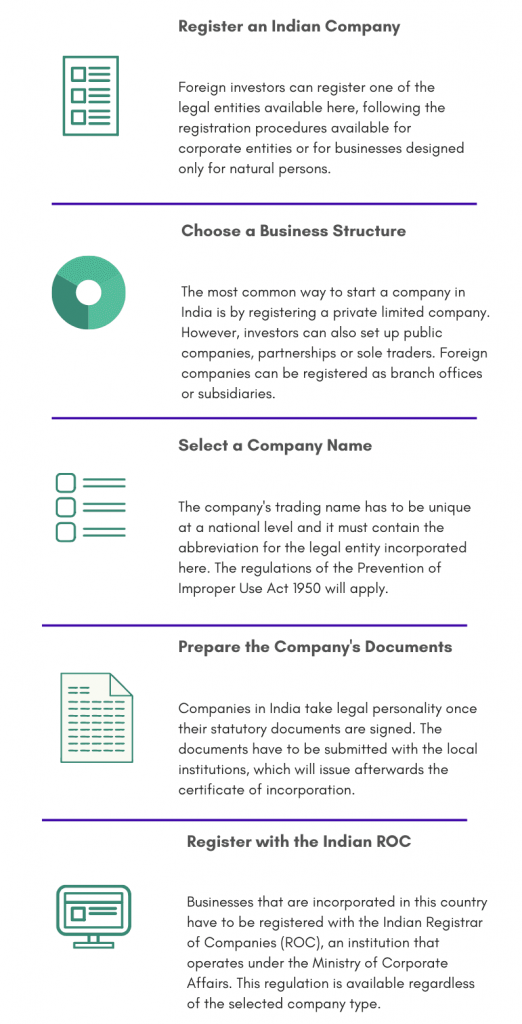

Open a Company in India

How?

Advantages of Open a Company in India

Private Limited Company in India

Limited Liablity Partnership (LLP)

One Person Company (OPC)

Partnership Firm

Business Plan

Frequently Asked Questions ( Private Limited Company )

- No , you need not have separate office for incorporation of company , Your residential/ house address is sufficient to get your company incorporated.

- No , the entire incorporation process is online and you need not to move out from your comfort house or office.

- Scan copy of all documents can be sent through mail or else it can be couriered the same to company registered office address .

- There is absolutely no hidden cost on our portal . our charges in the packages are inclusive of all taxes .

- Yes, person in employment can be director of the company but before applying for DIN one should check employment agreement of the company he/she is working with, in order to ensure themselves about non violation of employment terms and condition of the said company.

Frequently Asked Questions ( LLP )

First Obtain designated partner identification number (DPIN / DIN) for the designated partners and also obtain Digital Signature.

a) Reservation of LLP name (e-form 1): This will take 3 to 4 working days for name approval.

- A minimum of two partners will be required for formation of an LLP. There will not be any limit to the maximum number of partners.

- Any individual or body corporate may be a partner in a LLP. However an individual shall not be capable of becoming a partner of a LLP, if—

(a) he has been found to be of unsound mind by a Court of competent jurisdiction and the finding is in force;

(b) he is an undischarged insolvent; or

(c) he has applied to be adjudicated as an insolvent and his application is pending.

- LLPs shall be registered with the Registrar of Companies (ROC) (appointed under the Companies Act, 1956) after following the provisions specified in the LLP Act. Every LLP shall have a registered office.

An Incorporation Document subscribed by at least two partners shall have to be delivered to the Registrar in a prescribed form. Contents of LLP Agreement, as may be prescribed, shall also be required to be filed with ROC.

- It has been provided in the Act that a document may be served on a LLP or a partner or designated partner by sending it by post or by any other mode (to be prescribed under Rules) at the registered office and any other address specifically declared by the LLP for the purpose in such form and manner as may be prescribed (in the rules).

Thus, an LLP shall have option to declare one more address (other than the registered office) for getting statutory notices/letters etc. from Registrar.

- An LLP shall be under obligation to maintain annual accounts reflecting true and fair view of its state of affairs. A “Statement of Accounts and Solvency” in prescribed form shall be filed by every LLP with the Registrar every year.

- Audit of LLPs shall be mandatory. However a more simplified compliance regime for small LLPs is being proposed by exempting such LLPs from the requirement of audit by exemption through notification by the Central Government.

Frequently Asked Questions ( OPC )

Section 2(62) of the Companies Act, 2013 defines OPC to mean a Company which has only one person as a member.

- As per section 3(1) and (2), OPC can only be incorporated as a private limited company. Such a company may either be:

1. A company limited by shares; or

2. A company limited by guarantee; or

3. An unlimited company

- The minimum capital requirement depends amount of many you can invest as capital.

- A Minor, Foreign citizen, Indian, Non-resident, a person incapacitate to contract are restricted from Forming a One Person Company.

- No, FDI is not allowed for One Person Company, if it does then it will lose its very nature of One Person Company.

- A. Check the Name Availability of Company by filing form INC-1.

B. File form INC-2 for Incorporation of OPC within 60 days of filing form INC-1.

C. File form INC-22 within 30 days of registration of form INC-2 in case of addresses are not same of correspondence and registered office.

- If the paid-up share capital of an OPC exceeds by 50 Lakh rupees or if the annual turnover of the OPC exceeds by 2 Crore Rupees in relevant period then the OPC has to convert itself into Private Limited Company or Public Limited Company mandatory.

Frequently Asked Questions ( Partnership Firm )

- A partnership is an association of two or more persons who carry on as co-owners and share profits. There can be a contribution of money (a capital investment in the business project) or services in return for a share of the profits.

- Unlike companies, partnerships are relatively informal business structures. Partnerships aren’t required to hold meetings, prepare minutes, elect officers, or issue stock certificates. Generally, partners share equally in the management of the partnership and its profits and losses, and assume equal responsibility for its debts and liabilities. These and other details are typically described in a partnership agreement.

No law requires partners to create a written partnership agreement, but it’s smart to do so. If you don’t make a partnership agreement, you run the risk that the default rules in your state’s partnership laws will govern your partnership in ways you and your partners won’t like.

Creating a written partnership agreement will also give you and your partners a chance to discuss your expectations of each other, define how each of you will participate in the business, and help you work out any sticky issues before they become major problems.

- A partnership does not pay any income taxes. Instead, partnership income “passes through” the business to the partner. Each person then reports his or her share of business profits or losses on an individual federal tax return.

- The biggest difference between a general or limited partnership and an LLP is that the general partners of any partnership are personally liable for any business debts. This means creditors can go after the partners’ personal assets while members of an LLP are not personally liable.

- The most common way to resolve business agreement disputes and enforce agreements is through the court system. However, courts and lawsuits are not the only option for businesses. Mediation and arbitration are also solutions.

- Usually not. A notary public (or notary) provides an acknowledgment that the signature appearing on the document is that of the person whose signature it purports to be. There is a requirement that some documents be notarized, such as a real property deed. Unless specifically required by state or municipal law, a written agreement does not have to be acknowledged before a notary public.

- (i) Partners are individually liable for business debts

(ii) Partners are subject to the actions of other partners.

(iii) Limited life of a partnership — if one partner leaves the partnership can end

(iv) Shared decision making means you do not have full control, which could lead to disagreements or paralysis of the partnership.

Request a Quote

About Us

Our services include incorporation, government registrations & filings, accounting, documentation and annual compliances. In addition, we offer a wide range of services to individuals, such as property agreements and tax filings.

About Us

Privacy Policy

Refund & Cancellation

Terms & Condition

Price in Other Currency[email protected] -

-